Introduction

As we progress through 2025, managing your financial well-being is more important than ever. Sunnyside Review 2025 aims to make this task easier. Whether your aim is to save for the future, track your spending, or learn about investing, Sunnyside offers a variety of tools intended to empower you in handling your finances. In this review of Sunnyside, we will explore its characteristics, benefits, drawbacks, and determine if it is a valuable choice for reaching your financial goals. With the ever-changing economic landscape, it’s essential to stay informed about the best financial practices, and Sunnyside provides the resources needed to navigate this complexity.

What is Sunnyside, precisely?

Sunnyside Review 2025 is a comprehensive financial wellness platform aimed at enhancing personal finance management. It offers users resources for budgeting, saving, investing, and boosting their financial knowledge. With its easy-to-navigate interface and clear resources, Sunnyside aims to simplify financial management for everyone, regardless of their level of financial knowledge.

It’s critical to comprehend the significance of financial wellbeing. Having a lot of money isn’t the only aspect of financial wellness; you also need to manage your money wisely in order to reach your objectives and feel less stressed. Sunnyside Review 2025 gives you the information and resources you need to improve your overall financial health and financial literacy.

These features are intended to serve consumers at various phases of their financial development. Sunnyside offers something for everyone, regardless of your level of experience with budgeting or your want to learn more about investing. Let’s examine these features in more detail and see how they can help you.

Main Features of Sunnyside:

- Customized Budgeting: Develop and oversee a budget that reflects your objectives and spending patterns. Consider using the goal-setting feature to allocate funds toward specific savings goals, such as a vacation or a new car.

- Automated Savings: Establish automatic transfers to effortlessly save for various financial goals. This feature eliminates the temptation to spend what you should be saving, making it easier to achieve your long-term objectives.

- Investment Tools: Gain access to straightforward investment tools, including suggestions for diversified portfolios. This section can guide you in understanding risk tolerance and how to allocate your investments based on your financial goals.

- Financial Education: A variety of tools aimed at enhancing your comprehension of personal finance. From articles to interactive quizzes, these resources can help you become more confident in managing your money.

- Financial Support: Customized guidance from financial professionals to assist you in making knowledgeable financial decisions. This can be particularly beneficial during major life changes such as buying a home or planning for retirement.

Sunnyside’s benefits go beyond just its characteristics. Increased financial clarity and confidence have been observed by users, which can have a big impact on their general wellbeing. Additionally, the site promotes involvement, which makes managing finances a more interesting undertaking.

Advantages of Choosing Sunnyside:

Notwithstanding its advantages, the subscription model could be difficult for certain consumers. But frequently, the benefits outweigh the drawbacks, particularly when taking into account the possibility of better financial results. Before making a commitment, it’s critical to consider these aspects in relation to your financial status.

✅ Intuitive interface: The straightforward design makes it easy to manage finances, even for individuals with minimal financial expertise.

✅ Extensive financial resources: It addresses a broad spectrum of financial requirements, from budgeting to investing.

✅ Time-efficient automation: Optimize your budgeting and saving tasks through automated features.

✅ Financial coaching and support: Receive customized financial guidance suited to your unique circumstances.

✅ Educational materials: Discover how to manage finances, invest wisely, and reach financial independence.

Disadvantages of Using Sunnyside:

❌ Subscription necessary for premium features: While basic tools are accessible for free, complete access to all functionalities requires a paid subscription.

❌ Investment guidance may not fit everyone: People seeking in-depth or proactive investment strategies might find Sunnyside’s services too basic.

❌ Limited functionality on mobile: Numerous users have reported that the mobile application lacks certain features available in the desktop version.

Is Sunnyside a Valuable Choice in 2025?

Definitely! Sunnyside Review 2025 serves as an excellent financial wellness platform for individuals wanting to gain control over their finances. Whether your objective is to begin budgeting, increase savings, or explore investing, Sunnyside Review 2025 provides a straightforward and easy-to-use approach to accomplishing those goals. Although the cost of premium features may deter some, the overall advantages provided through various tools and personalized support are worth considering for your financial journey in 2025.

Who Should Think About Sunnyside?

- Individuals wanting to enhance their financial well-being and knowledge

- Those needing assistance with budgeting or saving for particular objectives

- Newcomers interested in learning about investing

- Anyone in search of tailored financial coaching and advice

Sunnyside’s Distinctive Features in 2025

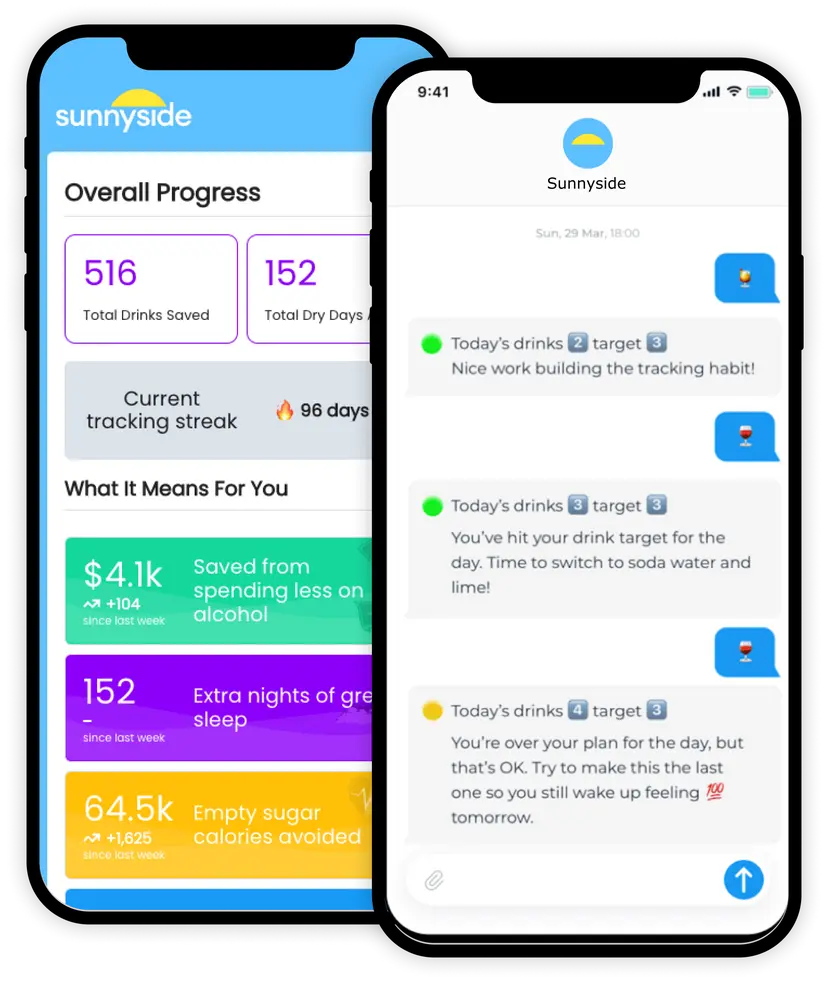

What distinguishes Sunnyside Review 2025 is its compassionate and user-centric approach. In contrast to conventional sobriety applications that often adopt an all-or-nothing mindset, Sunnyside champions a more pragmatic, evidence-based strategy: mindful drinking. This new outlook is particularly beneficial for business professionals who may not wish to completely cut alcohol from their lives but are striving for enhanced control and mindfulness.

The app’s effortless onboarding experience and user-friendly dashboard make it exceptionally easy to weave into a hectic lifestyle. You can set tailored objectives, receive timely prompts, and assess your progress—all without the need to track every detail manually. It’s akin to having a virtual wellness coach that comprehends your schedule and adjusts accordingly.

Sunnyside Review 2025 also provides daily motivational suggestions, progress updates, and behavioral insights through SMS and email. These minor prompts are effective in strengthening better decision-making, particularly during stressful situations when individuals are most prone to stray from their goals. The most appealing aspect? It doesn’t come across as mechanical or sermonizing. Instead, it resembles a supportive companion who consistently prioritizes your well-being.

The Real Business Benefits of Mindful Drinking

There is a rising recognition in the corporate realm regarding how lifestyle choices impact performance. With an increasing number of CEOs, startup founders, and team leaders endorsing mental health and wellness, resources like Sunnyside Review 2025 are becoming indispensable. A clear mind and a healthy body are valuable assets in the fast-paced business environment of today.

By utilizing Sunnyside, professionals can enjoy:

- Enhanced focus and improved decision-making

- Better sleep quality and energy levels

- Greater emotional stability during tense meetings or negotiations

- Reduced sick days and health-related issues

- These advantages directly lead to stronger leadership, boosted productivity, and sustainable business expansion.

Is It a Wise Investment?

Given the cost associated with poor habits—from medical expenses to missed business opportunities—Sunnyside’s pricing is quite reasonable. It represents a low-risk, high-reward investment in both personal and professional growth.

Additionally, with its continually advancing features, attentive support team, and clear data policies, Sunnyside demonstrates its commitment for the long haul. For any business-oriented individual seeking to harmonize their personal health with their career aspirations, this app is not merely useful—it’s crucial.

Final Conclusion:

In 2025, Sunnyside Review 2025 continues to be a formidable player in the personal finance arena. Its intuitive design, automated features, and extensive tools make it an outstanding option for anyone looking to handle their finances more effectively. Although there are some downsides concerning the mobile app and the fees for premium features, the overall offerings of the platform establish it as a solid choice for those wanting to improve their financial wellness.

All things considered, Sunnyside Review 2025 is a noteworthy development in financial wellness technology that attempts to close the gap between people and their financial objectives. It gives individuals the ability to take control of their financial destinies by encouraging a proactive attitude to personal finance.